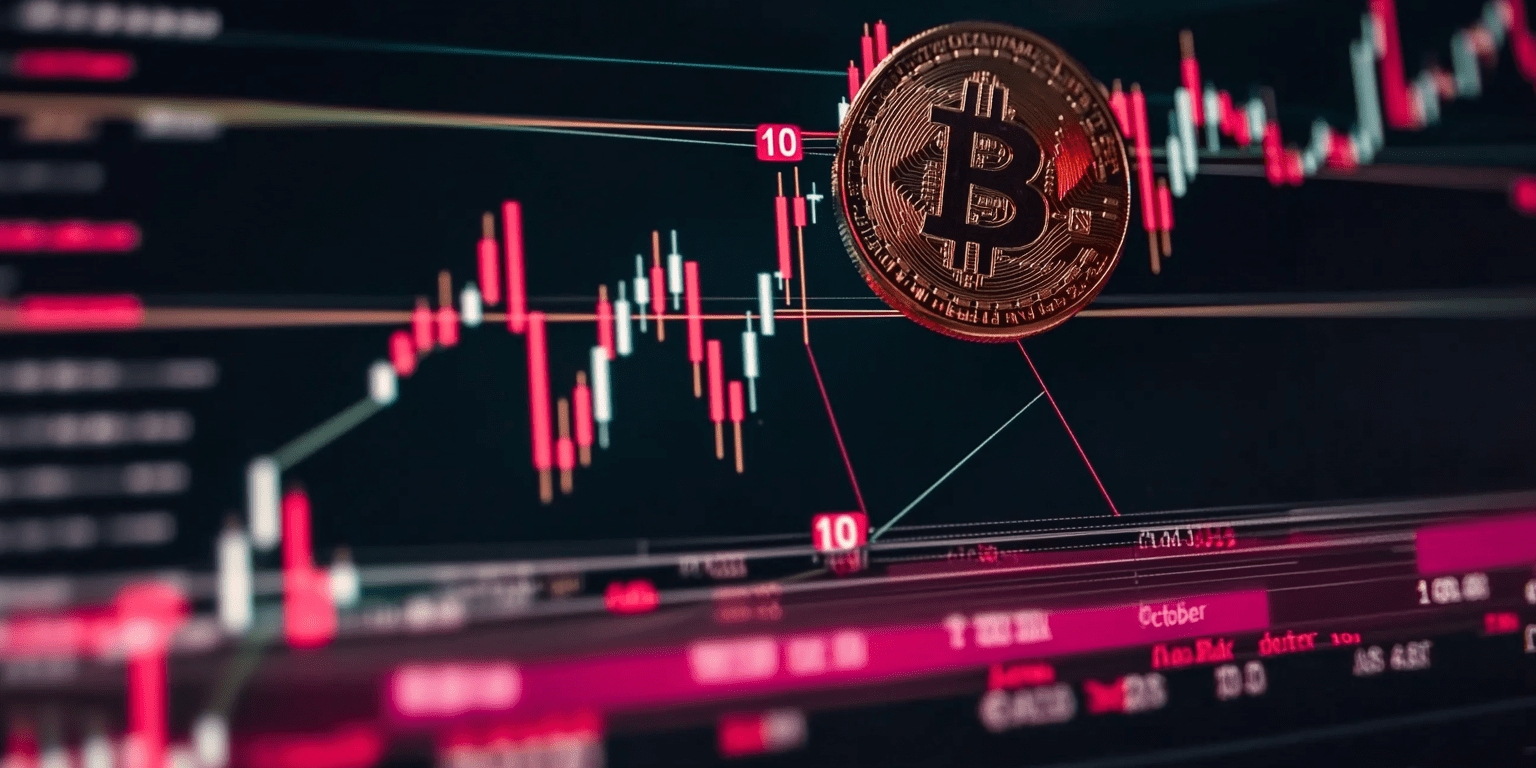

The post Crypto Treasuries Halt Bitcocom. Crypto treasury companies are taking a step back after the recent market downturn earlier this month. These firms, which hold large amounts of Bitcoin and Ethereum on their balance sheets have nearly stopped buying since prices tumbled on October 10. The slowdown shows an ongoing sense of caution across the sector. Coinbase’s Head of Institutional Research, David Duong, noted that Bitcoin buying activity among treasury companies dropped to the lowest level this year and has yet to rebound. Bitcoin Buying Halts as Confidence Weakens The pause in Bitcoin purchases by crypto treasury companies is a clear sign that large firms are uncertain about market direction. These organisations typically act as strong buyers when prices dip and help to stabilise volatility. Their silence now indicates that they have limited faith in any near-term recovery. Duong described these companies as “heavy hitters with deep pockets.” He explained that their lack of activity shows caution, even at current support levels. Because of this, many of these companies have chosen to guard their cash reserves. There is one exception, though, and this is BitMine Immersion Technologies. The Ethereum-focused company has continued its aggressive buying spree. Since October 10, BitMine has reportedly spent over $1. 9 billion to acquire nearly 483, 000 ETH. Ethereum followed Bitcoin’s drop earlier in October, falling more than 15% to around $3,686 before climbing back to $4,130. Without BitMine’s steady buying, Ethereum demand among treasury companies would have turned negative. Market Fragility Amid Fading Institutional Support Duong warned that if BitMine slows its activity, overall corporate buying could collapse. He noted that the market looks fragile when the biggest discretionary balance sheets are inactive. The absence of.