Year: 2025

Gangwon FC vs Machida Zelvia Prediction and Betting Tips | 25th November 2025

Gangwon FC vs Machida Zelvia Prediction and Betting Tips | 25th November 2025

3 costly home equity borrowing mistakes to avoid before 2026

To better ensure home equity borrowing success, homeowners should avoid these mistakes in the final weeks of 2025.

4 Actors Most Likely to Play James Bond Next, According to Current Odds

Plenty of the U. K.’s most popular leading men have been linked to the role in recent years, but the Denis-Villeneuve-directed movie has still yet to begin casting. The [.] The post 4 Actors Most Likely to Play James Bond Next, According to Current Odds appeared first on PopCulture. com.

Meet the 2025 OK Black all-conference football team

Meet the 2025 OK Black all-conference football team

Stephanie McMahon reveals her daughter wrestled 18-time WWE champion

Stephanie McMahon reveals her daughter wrestled 18-time WWE champion

Report: Jayden Daniels to practice this week, unlikely to play against Broncos

Report: Jayden Daniels to practice this week, unlikely to play against Broncos

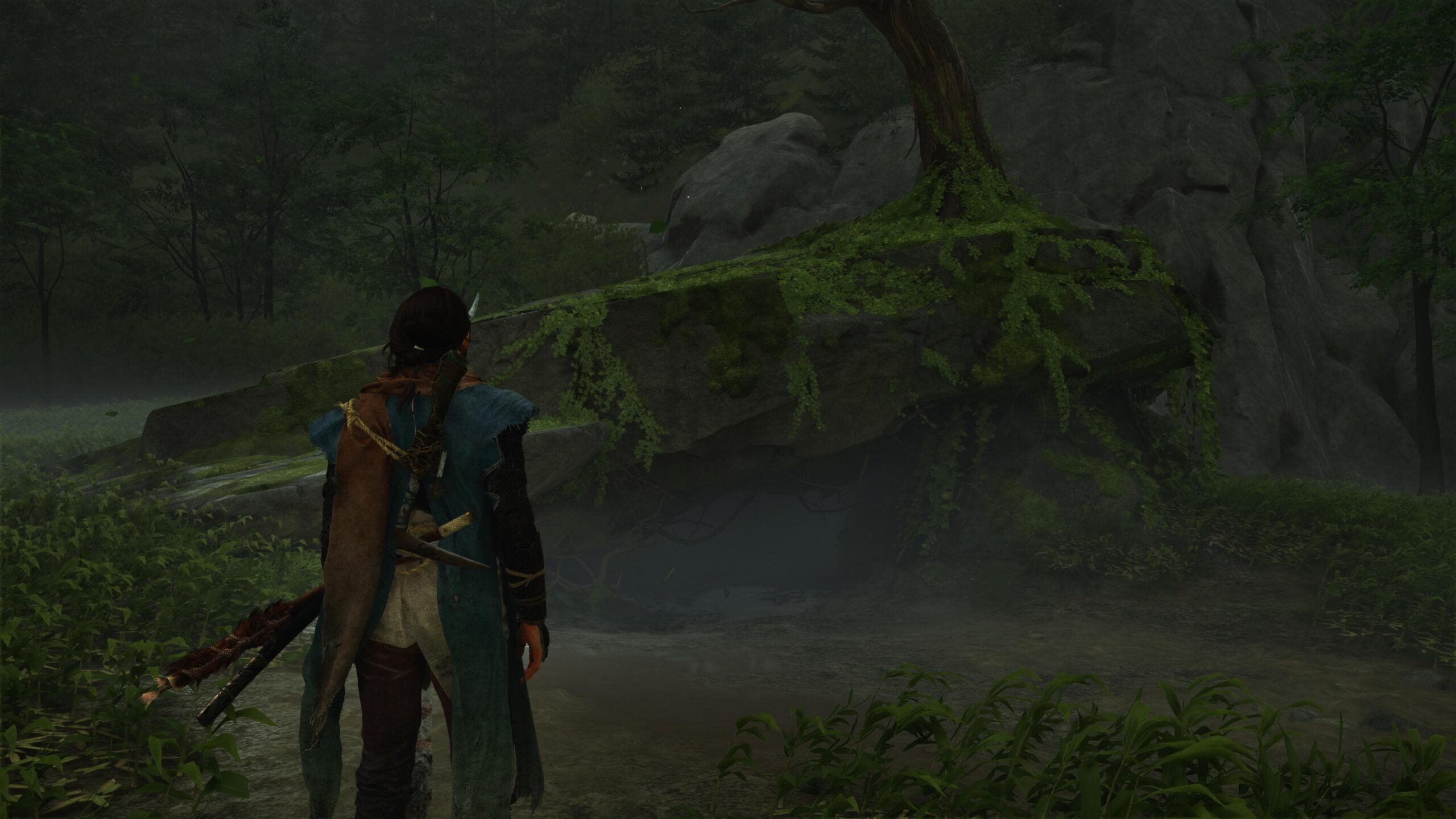

How to defeat the Astral Academy bird boss in Constance

How to defeat the Astral Academy bird boss in Constance

Rock legend hospitalized after Pa. show: ‘Couldn’t stop vomitting’

News of the final shows’ postponement broke last week.

“I see Tilak Varma coming into the XI” – Former stumper’s huge statement on India’s team combination for IND vs SA 2025 ODIs

Former India keeper-batter Saba Karim has backed Tilak Varma as India’s No. 4 for the ODIs against South Africa in Shreyas Iyer’s absence.