**XRP’s Realized Profit Metric Reveals 240% Surge in Daily Profit Realization Amid Recent Price Drop**

XRP has experienced a notable 240% increase in daily profit realization volume during the recent price plunge, according to Glassnode data. Seasoned traders have been offloading large volumes of tokens, contributing to the sustained downward pressure on XRP’s price. Over the past week, the token has dropped more than 9% to $2.29 despite several bullish developments, including Ripple’s $500 million funding round and ETF updates from issuers like Franklin Templeton.

In this article, we explore why XRP profit realization is spiking during price corrections and how this trend impacts investors. Stay informed on the latest crypto market dynamics and discover insights for smarter trading decisions.

—

### What Is Driving the Surge in XRP Profit Realization?

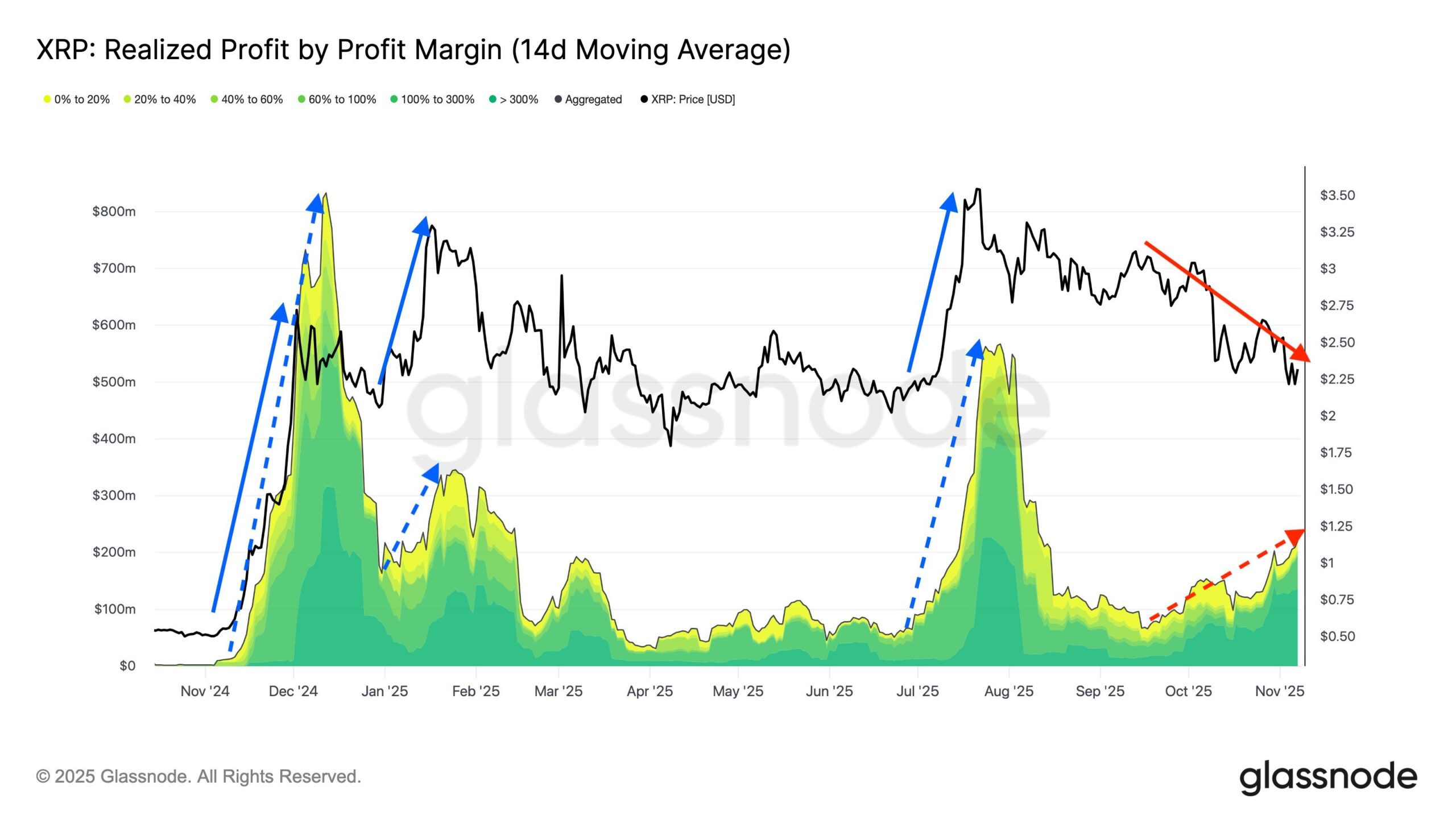

XRP profit realization refers to when investors sell their holdings to lock in gains. This is calculated by the difference between the token’s acquisition price and its sale price. Recent Glassnode data shows a dramatic rise in this activity, with the 7-day moving average of realized profit volume increasing from $65 million to $220 million daily — a staggering 240% surge.

This spike in profit realization coincides with XRP’s price falling from $3.09 to $2.30 since late September. Investors appear to be capitalizing on the correction rather than holding out for further rallies.

Glassnode’s “Realized Profit” metric offers a clear view of how profits are being distributed across different groups of holders. The data reveals that long-term holders are now actively securing gains amid increased volatility. Historically, such waves of profit-taking typically aligned with upward price movements. The current divergence suggests a shift in investor behavior — possibly signaling growing caution within the market.

—

### How Does XRP’s Price Correction Influence Investor Decisions?

The recent XRP price correction has triggered widespread profit-taking, especially among seasoned traders. Glassnode’s analysis indicates that in late October, these investors began offloading tokens en masse, amplifying the token’s decline.

Despite a series of bullish catalysts—including Ripple’s Swell event featuring prominent figures like Nasdaq CEO Adena Friedman and U.S. digital asset advisor Patrick Witt—the downward trend has persisted. Ripple’s announcements of a $500 million funding round, the acquisition of crypto custody firm Palisade, and a collaboration with Mastercard on the XRP Ledger have yet to translate into price gains.

Even updates to S-1 filings by ETF issuers such as Franklin Templeton, regarding spot XRP ETFs, have failed to reignite bullish momentum.

Experts suggest that this profit realization trend amid corrections could indicate market maturation, with investors increasingly prioritizing risk management over “holding through the storm.” Glassnode’s metrics show the 7-day average of daily realized profit has reached $220 million — a level unseen during prior stable periods.

On-chain analytics reinforce how XRP holders are adapting strategies in response to regulatory shifts and evolving market conditions. The concentration of realized profits among long-term holders, who had previously benefited from rallies, highlights a strategic pivot towards cautious profit-taking.

—

### Key Dynamics at a Glance

– **Profit surges during price drops:** Investors are locking in gains as the token’s value declines.

– **Traders offload amid news:** Despite positive news, selling pressure increases.

– **Price remains pressured:** Intense profit-taking challenges XRP’s recovery in the short term.

This selling activity creates a headwind that tempers the effects of positive developments around XRP, complicating its recovery path.

—

### Frequently Asked Questions

**What Causes XRP Profit Realization to Spike During Price Drops?**

Profit realization spikes when investors seek to lock in gains during price corrections to mitigate potential losses. Glassnode’s data highlights a 240% daily increase to $220 million in realized profits as XRP’s price corrected from $3.09 to $2.30. This behavior shows a risk-averse response to current market volatility.

—

**Why Isn’t Bullish Ripple News Boosting XRP Prices?**

Bullish news like Ripple’s $500 million funding round and ETF updates haven’t propelled XRP prices due to significant profit-taking by investors. According to Glassnode, intense selling amid on-chain activity overshadows positive announcements, keeping XRP trading lower at around $2.29 after a 9% weekly drop.

—

### Key Takeaways

– **XRP Profit Realization Surge:** The 240% jump to $220 million daily underscores investors’ focus on securing gains during correction phases.

– **Impact of Market Correction:** The drop from $3.09 to $2.30 has triggered mass token offloading by experienced traders, adding downward pressure despite optimistic Ripple developments.

– **Challenges for Recovery:** While bullish catalysts such as ETF filings and partnerships with Mastercard hold long-term promise, current profit-taking behaviors present obstacles to near-term rebounds. Monitoring on-chain data is crucial for spotting shifts in investor sentiment.

—

### Conclusion

XRP’s recent price correction has highlighted a significant shift in investor behavior, characterized by heightened profit realization amid market volatility. Although positive news continues to emerge for Ripple and its ecosystem, the intensified selling activity—especially by long-term holders—places immediate pressure on XRP’s price recovery.

Investors and traders should stay vigilant, leveraging on-chain insights and broader market analysis to navigate this evolving landscape effectively.

—

*Stay tuned for more updates and expert insights on XRP and the wider cryptocurrency market.*

https://bitcoinethereumnews.com/tech/xrp-profit-realization-surges-amid-price-correction-despite-bullish-catalysts/