Top Stories

View AllTechnology

View AllAt 87, he can’t afford his rent without a roommate. He’s far from alone.

Alan Ferber, 87, shares a fourth-floor walk-up apartment in New York City with a roommate to manage escalating rent costs, which have become increasingly difficult…

Health

View AllList Posts

View All2/10: The Takeout with Major Garrett

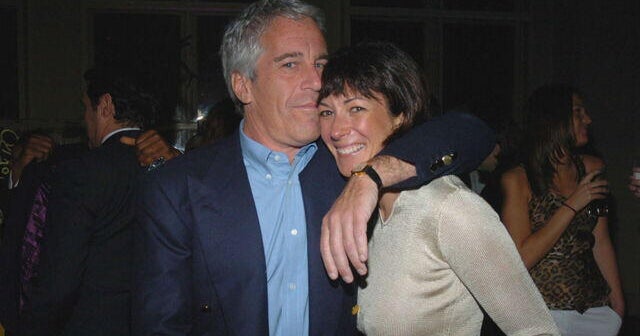

**Ex-Police Chief Says President Trump Thanked Him for Stopping Epstein, Calls Ghislaine Maxwell "Evil"** A former police chief has revealed…

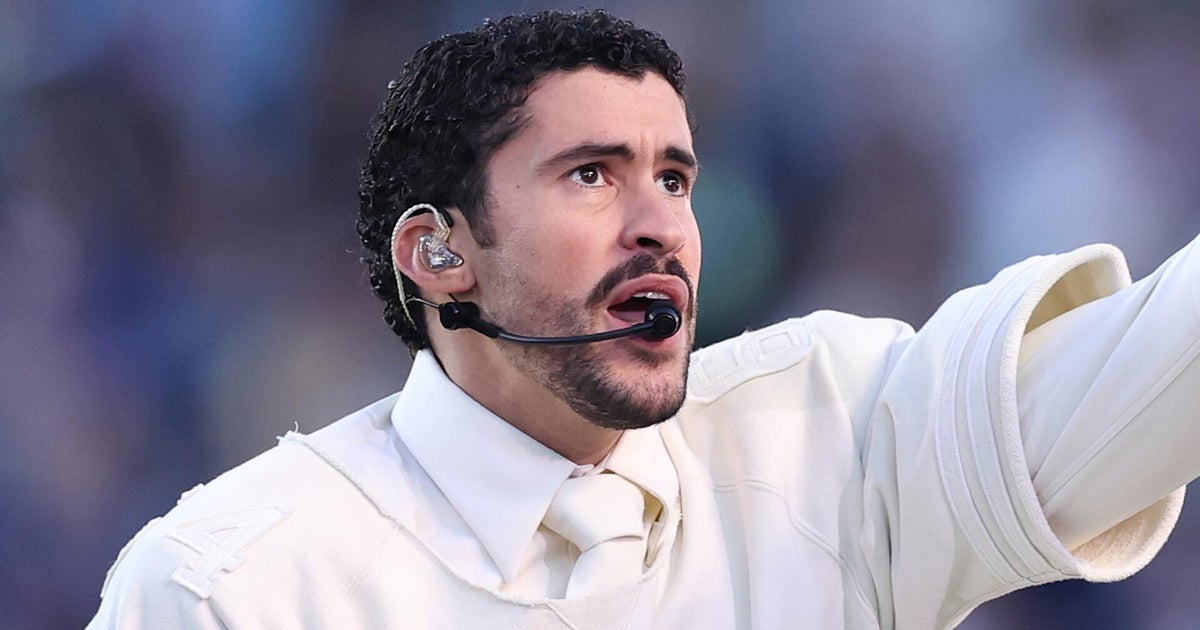

Bad Bunny and the politics of the Super Bowl

The Super Bowl is more than just a football game. It is an entertainment spectacle that captures the attention of…

L.A. seeks to dump the federal judge overseeing a homelessness settlement

One day before a hearing to explore whether the city of Los Angeles misled a federal court regarding its plan…

Thieves guide man into SUV in River North, rob him at gunpoint before dropping him off: CPD

CHICAGO (WLS) — Two armed suspects took a man into an SUV and robbed him at gunpoint before dropping him…

Lifestyle

View AllEnergy policy is impeding affordable electricity options for Ohioans: Letter to the Editor

Thank you for covering how cold winter temperatures are straining the power grid and driving up electricity prices (“Regional power grid bracing for record-breaking winter…