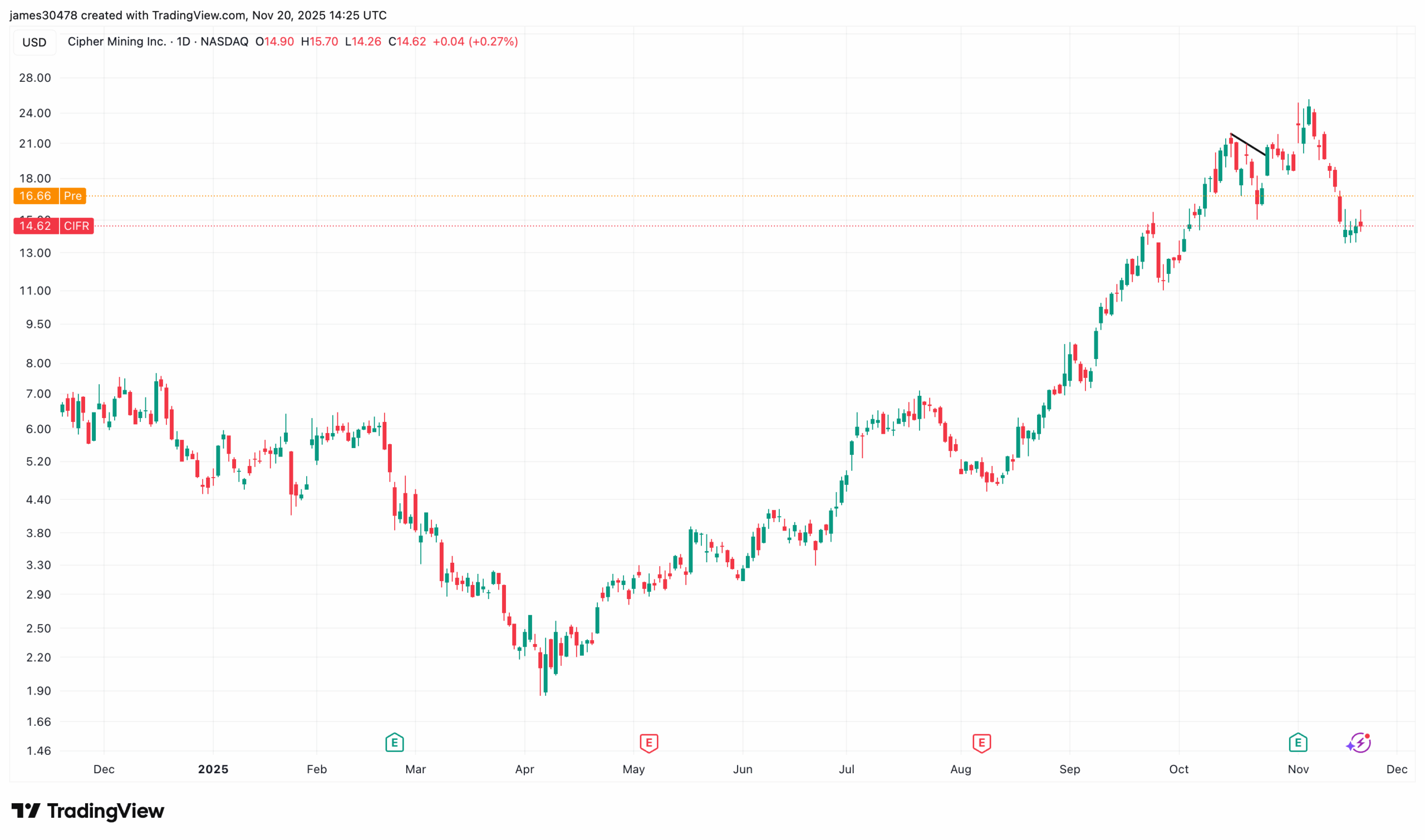

Bitcoin Nears End Of 2022–2025 Market Cycle: CryptoQuant

The post Bitcoin Nears End Of 2022-2025 Market Cycle: CryptoQuant appeared com. Bitcoin is entering bearish territory as institutional demand dries up and key market indicators point to a downward phase, according to data from analytics platform CryptoQuant. Bitcoin (BTC) market conditions have turned the “most bearish” within the current bull cycle that started in January 2023, CryptoQuant said in its latest crypto weekly report shared with Cointelegraph. CryptoQuant’s Bull Score Index has declined to extreme bearish levels of 20/100, while the BTC price has fallen far below the 365-day moving average of $102,000 a key technical level and the final bearish signal marking the start of the 2022 bear market. The price drop comes amid weakening institutional demand, including reduced buying by Bitcoin treasury firms such as Michael Saylor’s Strategy, along with limited inflows into exchange-traded funds (ETFs). Corporate Bitcoin demand tapers off Even with Strategy’s latest purchase of 8, 178 BTC ($835 million) its largest acquisition since July 2025 the buy remains significantly smaller than many of its previous major purchases, CryptoQuant’s head of research Julio Moreno noted in an X post on Wednesday. “Treasury companies have basically stopped buying, some have even sold part of their holdings,” Moreno observed, referring to companies like Metaplanet, whose most recent BTC purchase was in September. 4 billion around 30% below last year’s total of $41. 7 billion, according to data from CoinShares. Key market drivers “off the cards” Addressing the past key market catalysts, CryptoQuant mentioned Donald Trump’s presidential election win in 2024, which pushed Bitcoin above $100,000 for the first time by early December. In 2025, the launch of several Bitcoin Treasury Companies pushed Bitcoin above $120,000 in August. “Those catalysts are now gone,” the report states, adding: “What.