Tag: announcements

The Game Awards 2025 winners, announcements & trailers

The Game Awards 2025 winners, announcements & trailers

Watch the Xbox Partner Preview November 2025 event here

Watch the Xbox Partner Preview November 2025 event here

Anime Weapons Trello and Discord

Anime Weapons bring an interesting spin on the Arise Crossover-inspired Incremental Simulator games. Instead of summoning anime characters or shadows, you’ll be fighting with different anime weapons like Demon Slayer Nichirin swords, the Samehada from Naruto, etc. Luckily, you can check them all out and more on the Anime Weapons Trello and Discord. They’ve got info on: All Weapons All GamePasses All Worlds All Rank Ups All Champions All Items and Accessories All Titles All Stations The Trello is useful for tracking all the weapons in your current world and how to get them. The Weapons card under Misc. has them all listed in tables for each World. The table has both the NPC location who drops the weapon and the stats in base form and Star upgrades. Once you check out the Trello, the Discord is your best bet to keep track of all the new content coming up. Announcements, sneak-peaks and the updates channels all offer you a detailed overview of everything that is coming out or has been released. This included buffs and nerfs to weapons or champions as well as new Worlds and weapons. That’s it for my Anime Weapons Trello board and Discord server guide. Stay tuned for more Anime Weapons guides. The post Anime Weapons Trello and Discord appeared first on Destructoid.

These Should Definitely Be Followed in Altcoins in the New Week

The post These Should Definitely Be Followed com. As the cryptocurrency market enters a new week, analyst The DeFi Investor has published a watchlist of noteworthy project updates, events, and macro developments. The analyst’s assessments focus specifically on DeFi projects and upcoming ICO processes. One of the week’s most prominent headlines was the new rumors surrounding Hyperliquid (HYPE), which suggest the platform may soon launch a local lending and borrowing marketplace. On the Mantle (MNT) front, a large-scale livestream event called “State of Mind” will begin. New updates on the project roadmap will be shared during the broadcast. The most critical point of the week for the Ethereum and Arbitrum ecosystems is the start of the Devconnect conference tomorrow. Known as the Ethereum community’s largest technical event, Devconnect is at the center of many important announcements. On the HOME token side of the Defi App ecosystem, there are strong expectations that the Android mobile application may be released next week. On the macro side, the FOMC minutes to be released on November 19th are seen as critical for the direction of the markets. This week’s ICO agenda is also quite busy. Cookie Launchpad’s first ICO begins tomorrow, and the token sale for its trading platform, VOOI, will take place during this period. The Monad (MON) ICO on Coinbase will begin on November 17th. Maple Finance’s native token, SYRUP, will hold its fourth-quarter ecosystem call on November 19th, and a new roadmap will be announced as part of this call. Meanwhile, the Fluid team plans to announce new information for Fluid DEX V2 on November 21st. On Avalanche (AVAX), the Granite upgrade will be activated on the mainnet on November 19. Filecoin (FIL) announced that it will share a major announcement on November 18. Finally, the voting process for Aevo’s tokenomics upgrade proposal will begin tomorrow, and a significant.

Sony’s State of Play Japan was filled with indies, remakes, and DLC announcements, but these are the games I’m most excited for

Sony’s State of Play Japan has wrapped. In case you missed it, here are the top five announcements that stood out among a showcase primarily focused on remakes and DLC.

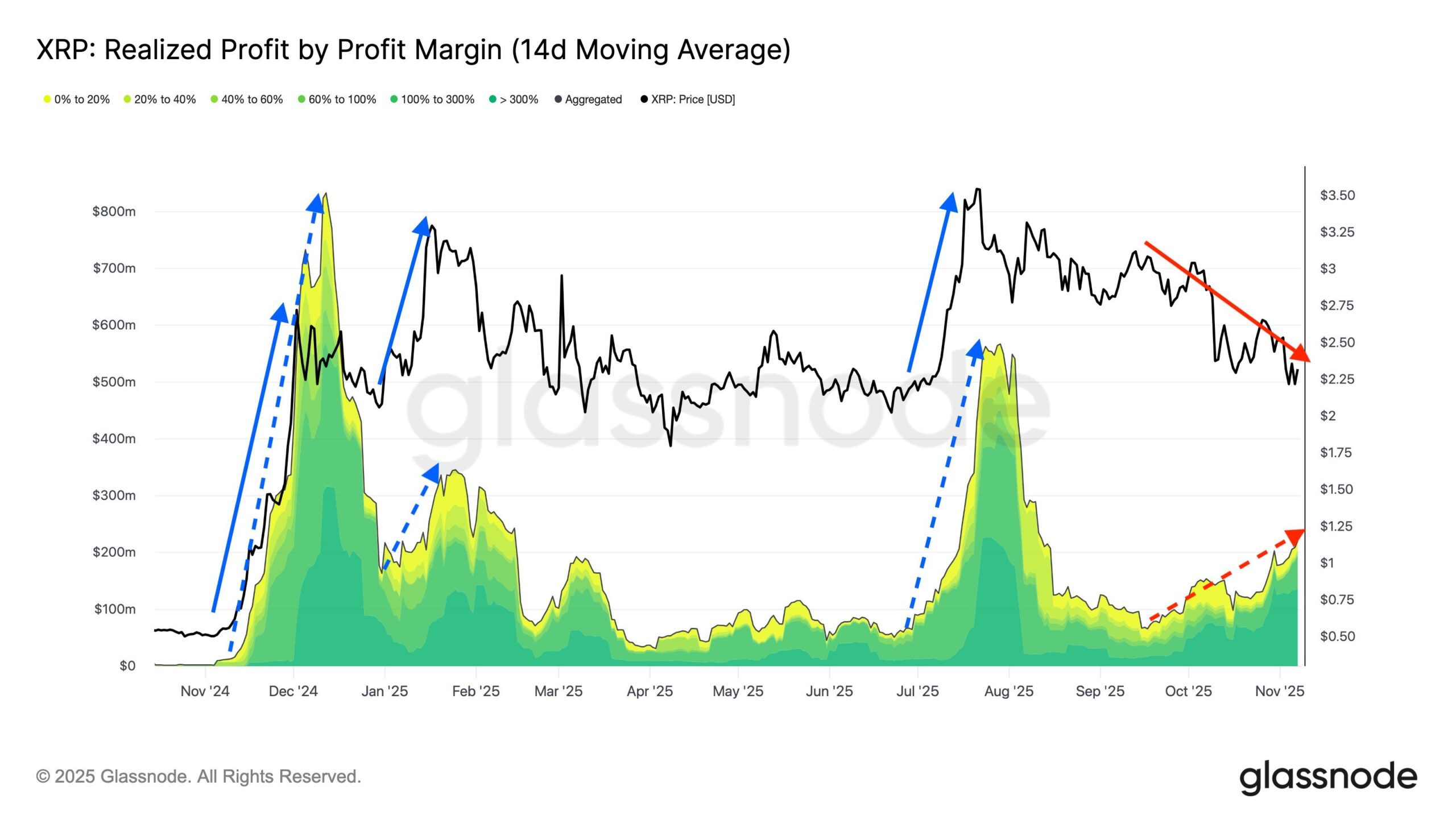

XRP Profit Realization Surges by 240%

The post XRP Profit Realization Surges by 240% appeared com. Recent Glassnode data shows that XRP investors are in the process of locking in gains en masse. The firm’s “Realized Profit” metric determines the total profit of a digital asset based on the difference between the “buy” and “sell” prices for the tokens, where the latter is higher. The metric is particularly useful for determining how realized profits are actually concentrated at different levels. Glassnode has noted that the token’s previous profit realization waves actually aligned with price rallies: long-term holders were tempted to secure significant gains. You Might Also RP, and.

XRP Profit Realization Surges Amid Price Correction Despite Bullish Catalysts

The post XRP Profit Realizaticom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → XRP profit realization has surged 240% to $220 million per day amid a price correction from $3. 09 to $2. 30, according to Glassnode data. Investors are locking in gains during this downturn, contrasting past rallies where long-term holders sold at peaks. This intense profit-taking persists despite positive Ripple developments. XRP’s realized profit metric highlights a 240% increase in daily profit realization volume during the recent price plunge. Seasoned traders have offloaded tokens en masse, contributing to the downward pressure on XRP’s price. The token has dropped over 9% in the past week to $2. 29, even with bullish events like Ripple’s $500 million funding round and ETF updates from issuers such as Franklin Templeton. Discover why XRP profit realization is spiking during price corrections and how it impacts investors. Stay informed on the latest crypto trends-explore more insights today for smarter trading decisions. What is Driving the Surge in XRP Profit Realization? XRP profit realization refers to the process where investors sell their holdings to lock in gains, calculated by the difference between acquisition and sale prices. Recent Glassnode data indicates.

Engie Brasil Energia S.A. (EGIEY) Q3 2025 Press Conference Call Transcript

Engie Brasil Energia S.A. (EGIEY) Q3 2025 Press Conference Call Transcript