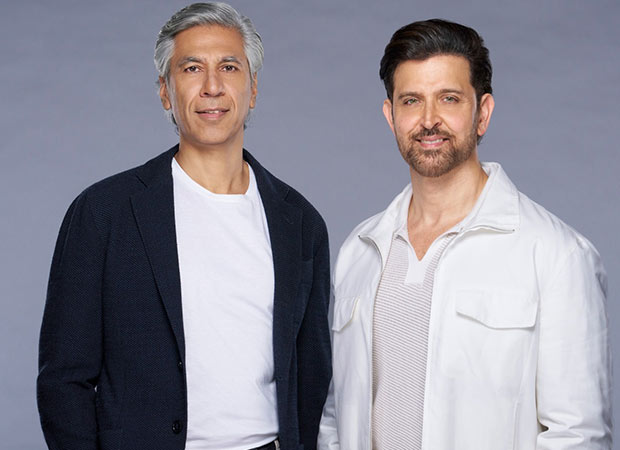

Hrithik Roshan becomes the brand ambassador for Gera’s WellnessCentric Homes

Gera Developments Private Limited (GDPL), pioneers in real estate innovation and creators of award-winning projects across Pune, Goa, Bengaluru, and California (USA), have once again set a new benchmark in modern living with the launch of Gera’s WellnessCentric Homes a first-of-its-kind residential concept in India that transforms holistic wellness into a measurable, everyday experience. After transforming the way young, modern families live with its pioneering ChildCentric® Homes, Gera Developments now takes the next step bringing wellness home, quite literally. Gera’s WellnessCentric Homes are envisioned as living ecosystems that foster balance between mind, body, and spirit through evidence-based design, thoughtfully curated wellness programs, and meaningful community engagement. With thoughtfully planned layouts, purified air, balanced natural light, and dedicated wellness zones, Gera’s WellnessCentric Homes combine design innovation with guided programs and community spaces that energize the body, calm the mind, and uplift the spirit. Reimagining modern living, the concept goes beyond conventional amenities grounding itself in wellness design, wellness infrastructure, and expert-led services to deliver measurable outcomes such as improved sleep, increased daylight exposure, and mindful movement. It brings structure and purpose to what was once an abstract lifestyle aspiration, making wellness a tangible part of everyday life. Residents will have access to a range of holistic wellness experiences, including yoga and Pilates sessions, aqua aerobics, nutrition consultations, personal fitness coaching, and community wellness initiatives all offered through collaborations with leading wellness experts. Rohit Gera, Managing Director, Gera Developments, said, “From ChildCentric® to WellnessCentric Homes, Gera Developments continues its journey of transforming homes from static spaces to intuitive ecosystems that enable residents to thrive. In today’s fast-paced life work has followed us home. Time for ourselves has shrunk. And while wellness continues to be desired, it is rarely sustained. We call this wellness inertia, and we set out to enable consumers to overcome it by creating an environment where pursuing a wellness lifestyle feels natural and effortless. Gera’s WellnessCentric Homes are designed around measurable outcomes from better sleep to balanced living and supported by a service ecosystem that integrates design, science, and lifestyle management. At the heart of it lies our vision of enabling residents to live unstoppable.”At the heart of the project lies the proprietary ‘3-tier Habit Infrastructure’, a framework that helps residents adopt and sustain wellness through: Nudge prompting healthy habits through design Support continuous expert guidance and community programmes Sustain flexible, personalised plans that encourage lifelong wellnessAdding resonance to this vision, Gera Developments announced Hrithik Roshan as the brand ambassador for Gera’s WellnessCentric Homes. Known for his discipline, balance, and commitment to holistic fitness, Roshan perfectly mirrors the philosophy of the concept. Actor and Gera WellnessCentric Homes brand ambassador Hrithik Roshan shared, “At the end of the day, we all are aspiring to enhance the quality of life for ourselves and our loved ones. Gera has put wellness at the epicentre of design, and that’s what makes the WellnessCentric Homes such a masterpiece. They represent the future of living, spaces that inspire balance, mindfulness and purpose every day. I wholeheartedly endorse their vision and I’m proud to represent a brand that is changing how we experience our home & everyday life.”Speaking about the partnership, Rohit Gera, said, “Hrithik’s association with Gera’s WellnessCentric Homes goes far beyond celebrity endorsement. His discipline, commitment to fitness, and belief in balance reflect the very philosophy we’ve built into these homes. He embodies the idea that wellness isn’t an act, but a way of life and that alignment makes this partnership truly meaningful.”With Gera’s WellnessCentric Homes, the company furthers its vision of innovation and customer-centric design reimagining homes not merely as places to live, but as dynamic environments that foster healthier, happier, and more connected lifestyles. Also Read : From Hrithik Roshan to Alia Bhatt: Star kids who prove talent trumps lineage!.