Nakamoto Holdings posts collateral twice as falling Bitcoin price strains debt

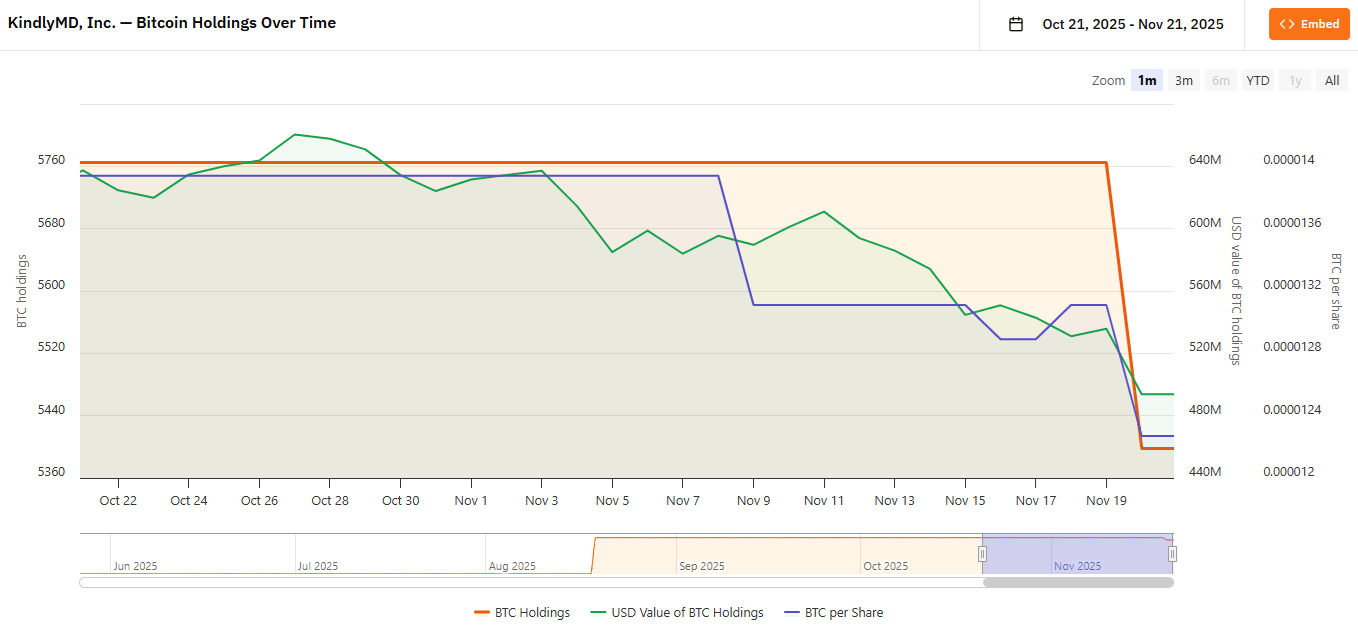

The post Nakamoto Holdings posts collateral twice as falling Bitcoin price strains debt appeared com. Nakamoto Holdings, formerly KindlyMD, is feeling the pressure of falling BTC prices. The company has posted collateral to its BTC-backed debt twice in the past days. Nakamoto Holdings (NAKA), which was created after a reverse merger with KindlyMD, is feeling pressure from the recent drop in BTC prices. The company had to post collateral twice to its structured debt backed by BTC. The company’s stock was already weakened from postponing the Q3 report, as the final result may include a $59M loss on the acquisition of Nakamoto Holdings. Nakamoto Holdings is within the top 20 of BTC treasury companies and is officially a ‘playbook’ company. This has affected the holding’s debt structure, as it used various instruments to build up its treasury. Nakamoto explains outflow from BTC treasury In the past week, Nakamoto was the only BTC DAT company to remove BTC from its treasury. In total, the reserves peaked at 5, 764 BTC, with most of the funds acquired in one tranche in August. Nakamoto Holdings, formerly KindlyMD, was the only DAT to move coins out of the treasury with the goal of reinvesting in BTC through other vehicles. Instead, Nakamoto used the BTC to invest in other treasury companies. Just to clarify, we didn’t “sell” bitcoin. We invested the Bitcoin across several international treasury companies @Treasury_BTC @Metaplanet @future_hodlings, as a core part of our strategy is monetizing our bitcoin balance sheet. Our direct Bitcoin balance does not capture the.- David Bailey🇵🇷 $1. 0mm/btc is the floor (@DavidFBailey) November 20, 2025 However, the community still suspected that some of the BTC had been sold. Bailey claimed exposure to BTC was what counted, but the company no longer controls the.