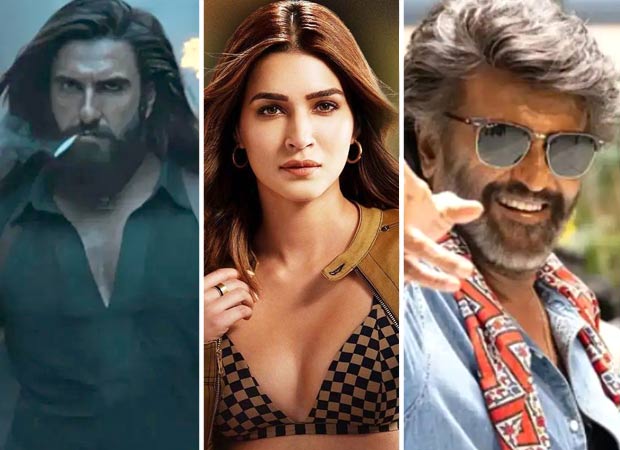

EXCLUSIVE: Ranveer Singh to promote Dhurandhar at closing ceremony of 56th International Film Festival of India in Goa on November 28; Kriti Sanon, Rajinkanth to also attend

Bollywood Hungama has been at the forefront in giving exclusive news about Dhurandhar. We were the first ones to break the news that 2000 Ranveer Singh fans will be in attendance at the grand trailer launch of Dhurandhar at Mumbai’s iconic Nita Mukesh Ambani Cultural Centre. Later, we informed readers that Dhurandhar is expected to have a run time of more than three hours. A day before the trailer launch, Bollywood Hungama broke the internet with the news that Dhurandhar is a two-part saga. And now, we are back with another exclusive piece of information about the much-awaited action entertainer. A source told us, “The team of Dhurandhar will make its presence felt at the 56th International Film Festival of India (IFFI), which is currently going on in Goa. The closing ceremony will be held at the expansive Dr. Shyama Prasad Mukherjee Indoor Stadium, Panjim, Goa, on the evening of the last day, that is, November 28. The Dhurandhar team will make its presence felt at this event. The closing ceremony of IFFI is usually grand and attended by several people from the media, industry and aam junta. Hence, it would serve as a perfect venue to speak about the film. Even for IFFI, this will prove beneficial as the presence of the team of the film will further add to the eyeballs.”The source continued, “Lead actor Ranveer Singh and director Aditya Dhar are expected to be there for sure. Ranveer is expected to perform on the songs of the film. Others from the team are also expected to be present at the IFFI closing ceremony.” Besides Ranveer Singh, Dhurandhar also stars Sanjay Dutt, Akshaye Khanna, R Madhavan, Arjun Rampal and Sara Arjun. It is backed by Jio Studios and B62 Studios. As per a creative shared by IFFI’s social media handle, Rajinikanth and Kriti Sanon are also going to attend the closing ceremony. The grand 2024 closing ceremonyBollywood Hungama was present at the closing ceremony of the 55th IFFI, held on November 28, 2024, and it was a star-studded affair. The highlight was that Rashmika Mandanna and producer Y Ravi Shankar promoted Pushpa 2 at the event. Allu Arjun was also scheduled to attend but had to cancel at the last moment. Also Read: Arjun Rampal credits Aditya Dhar for his ‘Angel of Death’ avatar in Dhurandhar; says, “Thanks to him for making us look so different and unrecognizable on screen”.