BTC Whales Move Big on Hyperliquid: $10M Binance Transfer, 5x ETH Long, and $108M BTC Short Exposure

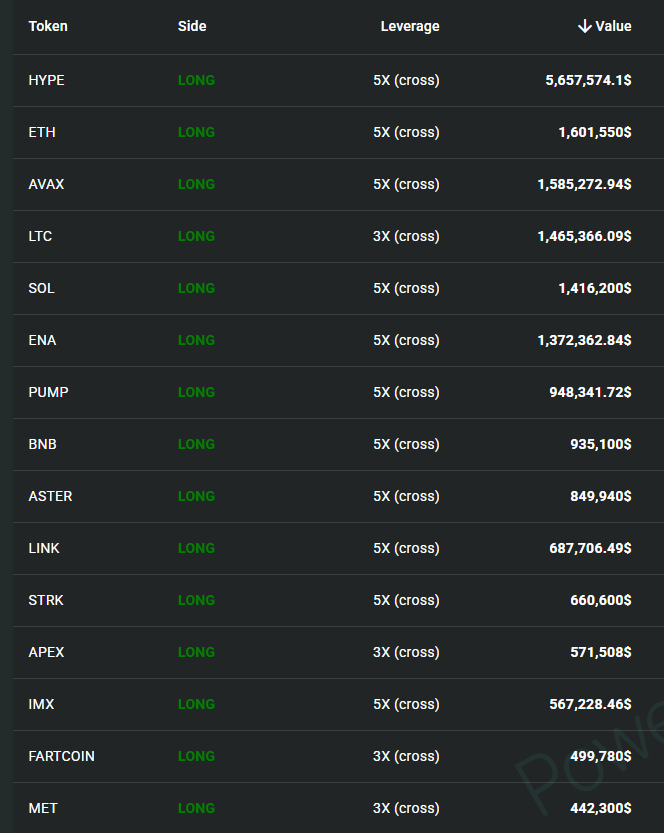

The post BTC Whales Move Big on Hyperliquid: $10M Binance Transfer, 5x ETH Long, and $108M BTC Short Exposure appeared com. COINOTAG News, November 25, citing Coinbob’s popular address tracker, reports a modest crypto market recovery and renewed liquidity signals across exchanges. The latest activity observed on Hyperliquid reveals a slate of substantial, leverage-enabled positions as traders recalibrate risk after recent volatility. The BTC OG Insider Whale reportedly moved $10 million from Binance to Hyperliquid, then opened a 5x ETH long sized at roughly $43. 95 million, entry around $2,945, with a liquidation threshold near $2,326. Calm Order Opener faced large liquidations totaling about $2. 8 million, while main positions include a BTC short of $22. 14 million with a floating loss of $1. 18 million and a liquidation price around $89,700; SOL short $15. 17 million with $1. 23 million floating loss and a liquidation price of $141. Ultimate Bear: BTC short about $108 million with a floating profit of $28. 51 million, a liquidation price of $94,000, and today deposited $3 million as margin to raise the liquidation price. Source:.